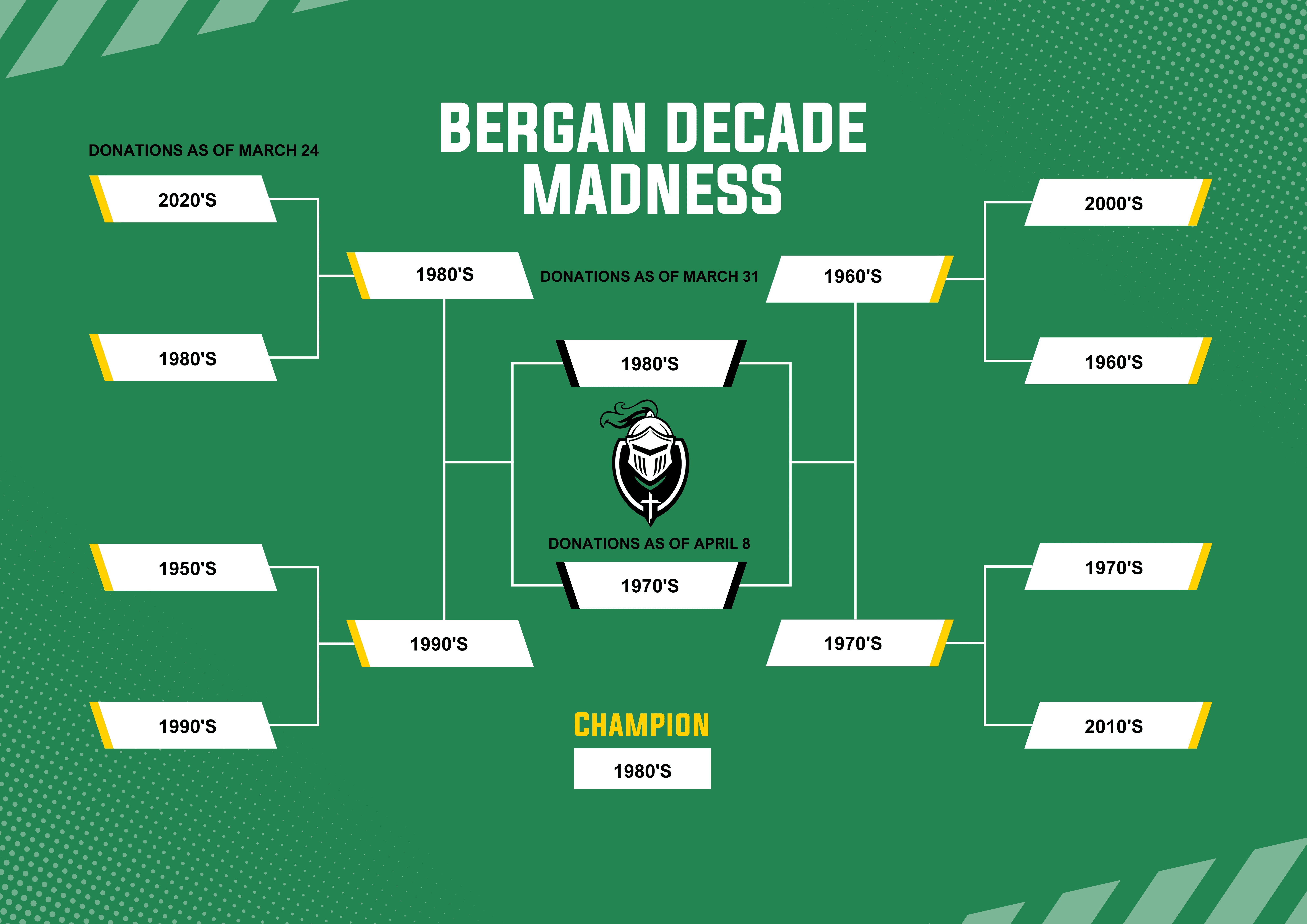

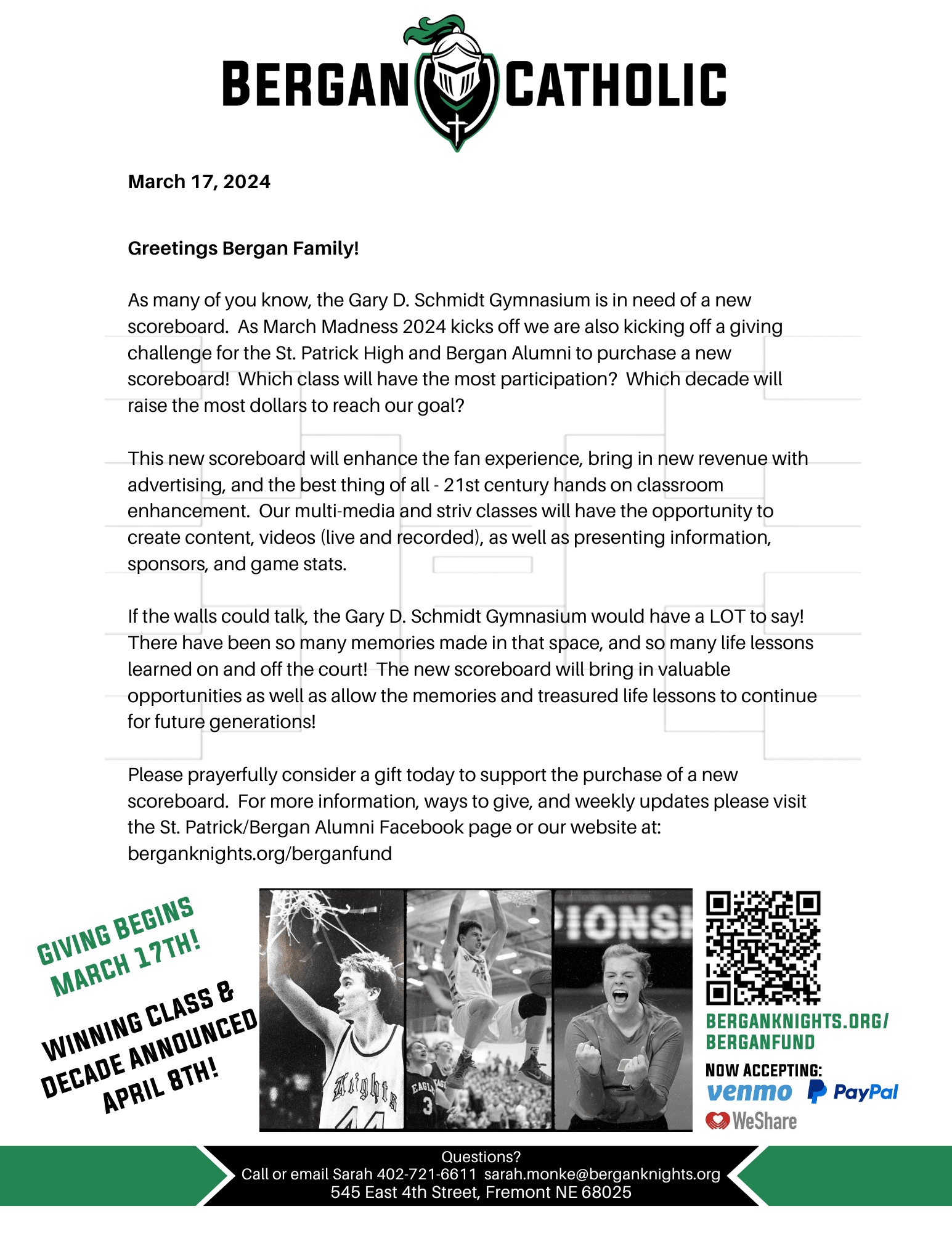

The 1980s are the CHAMPIONS!! Congratulations to the decade of the 80s for raising the most dollars! You accepted the giving challenge and raised the bar for years to come!

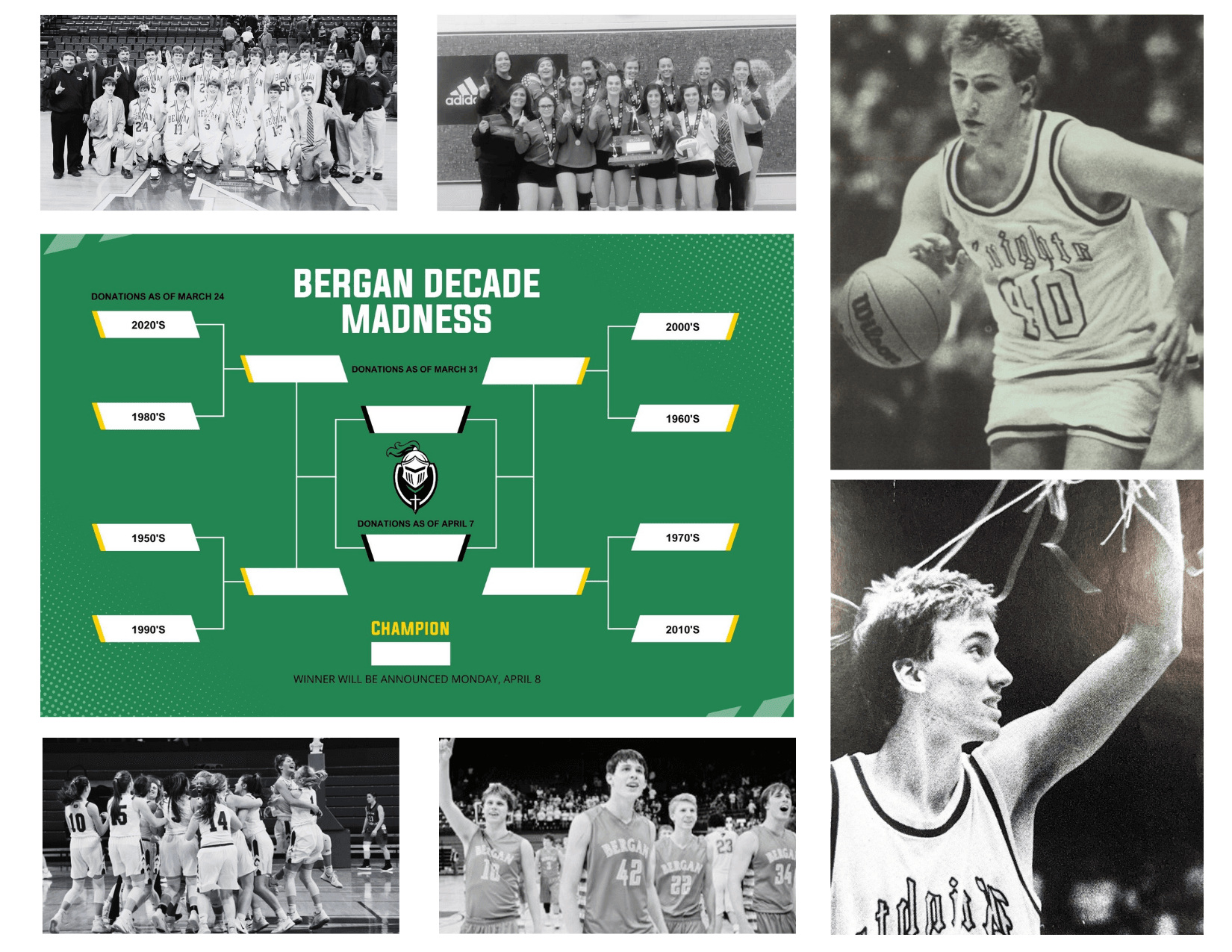

As many of you know, the Gary D. Schmidt Gymnasium was in need of a new scoreboard. As March Madness 2024 has wrapped up, now so is our Scoreboard Giving Challenge! Through this giving challenge the St. Patrick High and Bergan Alumni has purchased a new scoreboard! THANK YOU! Which class had the most participation? Drumroll please... the Class of 1969! CONGRATULATIONS!

Thank you to all who gave! The new scoreboard will bring in valuable opportunities as well as allow the memories and treasured life lessons to continue for future generations!

Ways to Contribute to the Bergan Fund

-

Matching Gift Program

Many companies provide matching gift programs that multiply their employees’ charitable donations.

To obtain a matching gift, contact your employer’s human resources department for a form or information about online procedures. Complete the donor/employee portion of the form and send it to:

Archbishop Bergan Catholic School, Finance Office

422 East 4th Street,

Fremont, NE 68025

The Finance department will complete their part of the form, and return it to the company to initiate its fulfillment of the match. -

As a donor, if you have a donor who does not need the RMD (Required Minimum Distribution), please keep in mind that the Charitable IRA Rollover provision is now available for their use for charitable gifting. This law allows an individual who is 72 years or older to gift up to $100,000 from his or her IRA, directly to a charity without having to recognize the IRA distribution as taxable income. This distribution counts toward the RMD.

Provisions:

The IRA owner must be age 72 years or older. The donor can transfer up to $100,000 directly from the IRA to a qualified charity. The transfer is not taxable to the IRA owner and can count toward the required minimum distribution. Due to the Internal Revenue Code restrictions, transfers to donor-advised funds do not qualify for the special rollover treatment. Nebraska Community Foundation has developed several tools to help your clients support their favorite charities through an IRA gift. Here are some Charitable IRA Rollover tools for your consideration. Download a letter of instruction for your IRA administrator, and read more about the benefits of an IRA Charitable Rollover.

-

Contact Sarah Monke to give in honor of your Memories!